Mumbai’s famous ice cream parlour told to vacate premise part of Brabourne Stadium

Khushi Shah – Mumbai Uncensored, 19th May 2022

Iconic Rustom ice cream parlour was recently ordered small causes court in Mumbai, to vacate its premises at the North Stand Building, part of the Brabourne Stadium, within two months. The decision resulted from a 26 year old suit filed in 1996 by the Cricket Club of India (CCI).

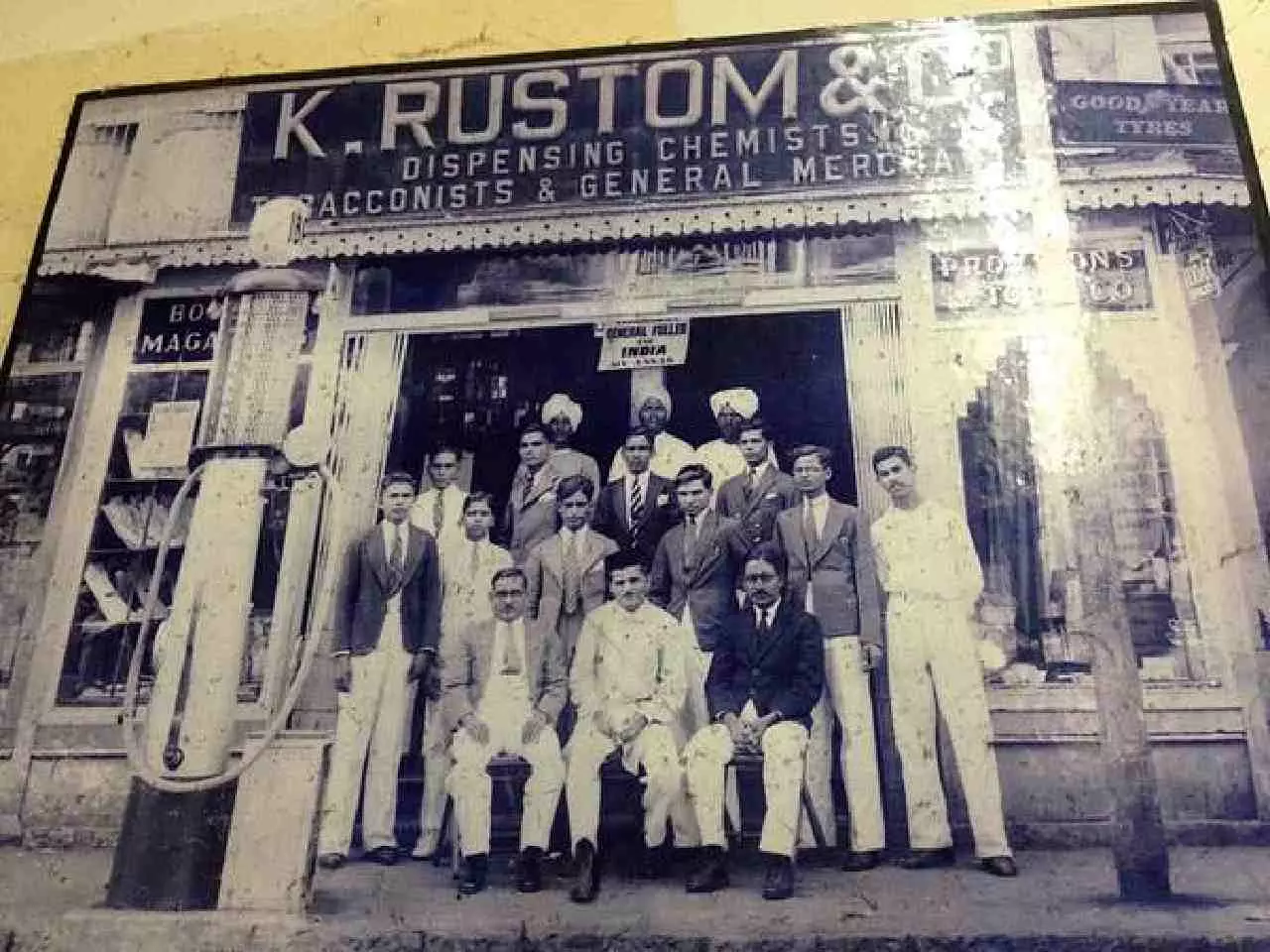

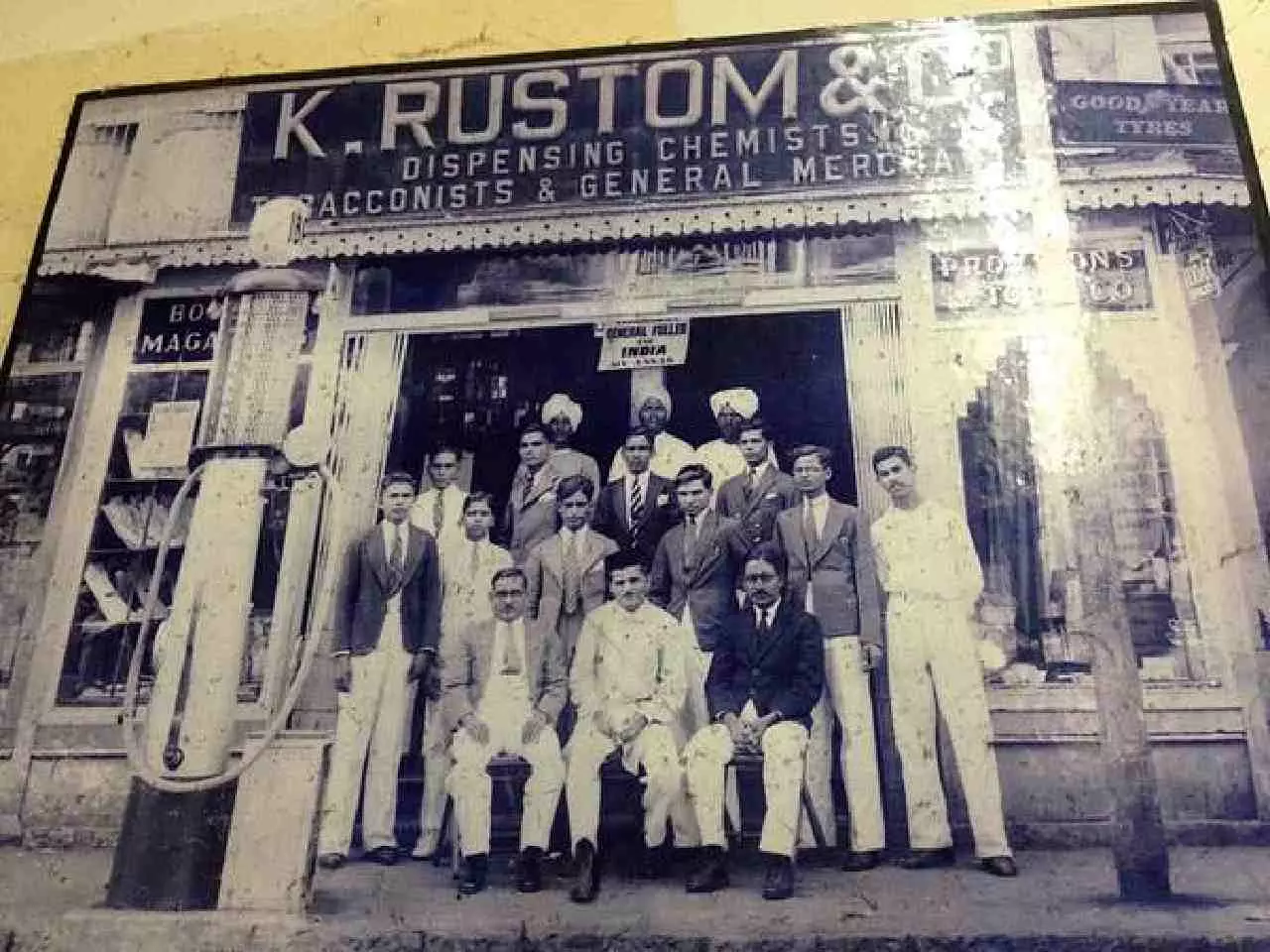

The story began in 1953 with K. Rustom and his family selling bars of ice-cream on beautiful glass and porcelain plates to tourists and families of Marine Drive, but several years and disappearing plates later, they came up with what they’re now best known for their ice-cream biscuits. K Rustom was the first tenant of the reclaimed land from Marine Drive to Churchgate. He bought the property at the rate of 1 Rs per square yard. At the small causes court, CCI had submitted that they were landlords of the said property under the Bombay Rent Act.

The land, upon suggestion from Lord Brabourne, was decided to use the space for CCI.The CCI told the court that they “need” the space.It was submitted that the club requires the premises for its activities. It said that the list of the club’s members has gone up substantially in the last 14 years and it needs more space to meet the growing requirement of the members. It said that it wants to start a coffee shop at the suit premises for its members as the current one at CCI is insufficient.

However, it has fought till the end, ensuring that the 84-year-old shop doesn’t shut down.

After the latest development in the long-standing legal battle, the news has sparked talk of a shutdown of the ice cream shop, with some urging Mumbaikars to “go and eat your last ice cream at K Rustom”.

The property in dispute comprises 3,070 square feet and a mezzanine floor of 950 square feet. The family has said that they will be filing an appeal against the order. The CCI submitted that a substantial portion of the premises were not in use by Rustom. CCI claimed that it was being paid a monthly rent of Rs 527 per month, ‘far below the standard rent’. Rustom replied by calling it an “incredible” statement as it does not mention the payment of electricity and water charges.

The owner also claims that they have been a tenant of the suit premises prior to the declaration of the Second World War “when premises were freely available” in Mumbai. Rustom also denied that a portion of the premises is not in use and said that both the ice-cream shop and a shop selling readymade clothes were working full time. It also said that it has no other premises to do business and will be out on the streets if asked to evict the premises.

After the latest development in the long-standing legal battle,, the Court of Small Causes directed Rustoms “to hand over quiet, vacant and peaceful possession” of its premises.

“It is already held that the plaintiffs have proved that, the suit premises are reasonably and bonafide required by the plaintiffs for their personal use for club activities and no hardship will be caused to the defendants if the decree of ejectment is passed in favour of the plaintiffs therefore, they are entitled to recover quit, vacant and peaceful possession of the suit premises,” Judge Todkar ordered.

Special Editions3 weeks ago

Special Editions3 weeks ago

Special Editions4 weeks ago

Special Editions4 weeks ago

Crime News4 weeks ago

Crime News4 weeks ago

Special Editions3 weeks ago

Special Editions3 weeks ago

Entertainment4 weeks ago

Entertainment4 weeks ago